CLARK BAR UPDATE: MAY 1ST 2023

Clark & Walker, P.C. - Attorneys at Law

Date: May 1, 2023

By: Christopher R. Walker, Esq.

SOURCE OF INCOME PROTECTION FACT SHEET

I. Overview of Section 8 Process

The Section 8 Housing Choice Voucher (HCV) Program provides housing assistance to eligible families by subsidizing a portion of their monthly rent. The Housing Assistance Provider pays the rental subsidy, or Housing Assistance Payment (HAP), directly to you each month under a HAP contract. The U.S. Department of Housing and Urban Development (HUD) funds the Program.

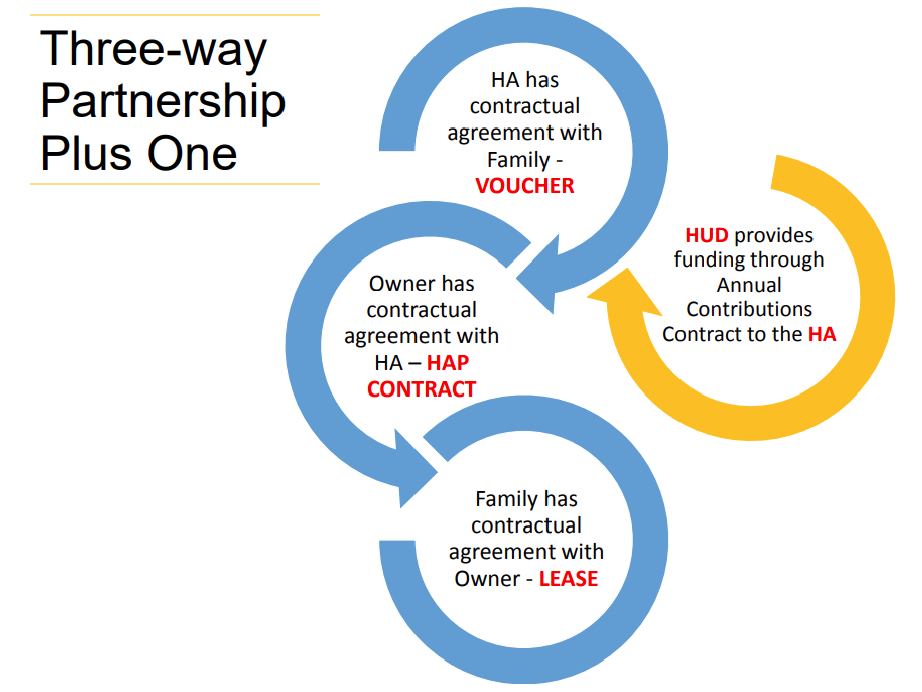

The HCV program is a three-way partnership between the Housing Assistance Provider, the tenant, and the landlord. The Housing Assistance provider will have a contract with the tenant, known as the voucher. The Housing Assistance Provider will then form a contract with the landlord, known as the Housing Assistance Provider contract or HAP Agreement. Lastly, the tenant will sign a contract with the landlord, known as a lease.

II. Overview of Approval Process

II. Overview of Approval Process

When a tenant seeks to rent a unit, he or she will have all the necessary paperwork to initiate the process. This required paperwork is called Request for Tenancy Approval (a.k.a. "RFTA" or "Searching Papers"), a packet of forms to be completed by the owner and signed by the owner and tenant. Instructions to complete the paperwork are included in the packet. The paperwork is not excessive and only takes a short time to complete. Once this packet has been completed and returned to the Section 8 department, the process begins.

The Housing Assistance Provider is not a party to the lease, but is required by the U.S. Department of Housing and Urban Development (HUD) to receive and review the landlord and tenant lease.

The Housing Assistance Provider must receive a copy of the unexecuted lease agreement along with the Request for Tenancy Approval. The lease must comply with state law and the Arizona Residential Landlord and Tenant Act and must not include any prohibited terms. The initial lease term must be at least twelve months in length.

Once the unit has been inspected and approved, the Housing Assistance Provider will request an executed lease in order to prepare the HAP contract. Once prepared, the HAP contract will be sent to the landlord for signature. Failure to submit documentation in a timely manner can result in the delay of payment or the cancellation of the Request for Tenancy Approval.

Once a tenant has applied and wants to use a voucher at your community, you will need to screen the resident for approval. If the resident passes your rental criteria (income discussed further below) you must then complete a Request for Tenancy and Approval Packet.

Based on preliminary discussions with Section 8, Section 8 acknowledges that the approval process for a Section 8 tenant is anywhere from thirty to sixty days from the date that Section 8 receives the signed searching papers from the landlord. The concern here is that the landlord will have to keep the unit available during this time period with no assurance that a lease will in fact be approved by Section 8. Most landlords provide that the tenant must sign the lease and move into the unit within a certain time frame of the lease being presented to the prospective tenant. Section 8’sm office in Phoenix has preliminarily suggested that such a rule would be enforceable and not a violation of the Source of Income rule. If this is in fact the position taken by Section 8, which we highly doubt, then landlords who have a neutral rule that requires the tenant to move into the unit and sign the lease within a certain time period can be applied here and may end up disqualifying the prospective tenant due to the processing delays from Section 8.

III. Payment Responsibility

Qualified tenants receive a Housing Choice Voucher from the Housing Assistance Provider and pay a portion (approximate 30 percent) of their income toward rent. The Housing Assistance Provider pays the difference between the tenant's rental portion (determined by the Housing Department) and the total contracted rent.

The Housing Assistance Provider pays the rental subsidy or Housing Assistance Payment (HAP), directly to you or your designated payee each month under a HAP contract. No charges or fees are assessed to owners for services provided under the Housing Choice Voucher Program. As a Section 8 owner or landlord, you will rent to families in the Section 8 Program just as you would rent to families without the benefit of a housing subsidy. You sign a contract with the Housing Assistance Provider and a lease with the tenant. Your relationship with the tenant is virtually like the open market.

The Housing Assistance Provider will be responsible for paying the housing assistance payment directly to the landlord. PLEASE NOTE, initial rent payments from the Housing Assistance Provider are typically 30-45 days after the execution of the HAP contract. Please know that the initial amounts from the Housing Assistance Provider will be late. Any remaining rent owed under the Lease is then owed directly by the tenant. The landlord cannot charge the tenant late fees or commence eviction proceedings based on untimely payments from the Housing Assistance Provider. The landlord may only charge late fees based on the tenant’s untimely payment of their portion owed.

IV. Income Qualification of Resident.

Prospective residents seeking to use a voucher at the community are required to pass all available rental criteria. You are not required to lessen your standard for rental history, financial, or criminal history background checks. However, there is a slight change to the way we income qualify a resident which is discussed below.

Traditionally, we would look at an application and require that the applicant make a certain amount of money each month to ensure payment of rent. Usually, we use the month rent multiplied by 2.5 or 3 to use as the baseline income a tenant must earn monthly to reside at the property. With the voucher, this process will be changed slightly.

Instead of using the full value of the rent that is charged monthly to income qualify a tenant we must only look to the tenant’s portion of the rent owed after we apply the value of the voucher. For example, if we have base rent of $2,300.00 and a housing voucher has been brought forward worth $750.00, the applicant would have to pay the remaining $1,550.00 ($750.00 + $1,550.00 = $2,300.00). To qualify from an income perspective, the applicant would need to earn, assuming a factor of three, three times his or her portion of the rent owed (i.e. $1,550.00). As such, the applicant would need to prove monthly income of $4,650.00 (3 X $1,550.00 = $4,650.00). If the applicant earns $4,650.00 monthly to be qualified for the unit. Assuming the applicant can satisfy that requirement and all other rental criteria are met, we would be proceeding with an approval and offer to rent. If the applicant does not meet this income requirement, then we would deny the application.

V. Landlord’s Obligations Under Section 8?

Under the Section 8 program, a landlord is responsible for the following tasks:

1. Tenant screening and selection;

2. Maintain unit consistent with the obligations set forth in the Arizona Residential Landlord and Tenant Act;

3. Comply with terms of HAP contract and HUD contract addendum;

4. Enforce the lease (issue non-compliance notices and evictions) Send to Housing Assistance Provider a copy of notices issued to tenants;

5. Have a local agent or representative available to work with the Housing Assistance Provider; and

6. Register the property as a rental with the Maricopa County Assessor’s office. See A.R.S. § 33-1902 (

https://www.mcassessor.maricopa.gov/).

If a landlord fails to maintain the property consistent with state law, the Housing Assistance Provider may abate the payment of the voucher to landlord and demand that the premises be repaired pending a re-inspection. During this time period, the rent will not be paid and will not later be repaid even after repairs to the premises are performed. The rent abated during this period will be lost.

VI. Terminations of Housing Voucher.

The Voucher may be terminated by the Housing Assistance Provider upon the occurrence of one of the following events:

1. Landlord evicts family;

2. Tenant terminates tenancy;

3. Tenant abandons unit;

4. There is death of a single member household (this includes single member households with a live-in aide); or

5. Housing Assistance Provider terminates tenant’s assistance for lease violation and/or HCV Program non-compliance.

If the landlord is seeking to terminate the Section 8 lease, the landlord must serve the appropriate termination notice on the tenant and must provide a copy of the notice to Section 8.

DOWNLOAD FACT SHEET

If you have questions about this information, please consult with an attorney.

Clark & Walker, P.C. - Attorneys at Law

www.clarkwalker.com

CONTACT A TEAM MEMBER: https://www.clarkwalker.com/About-Us.asp

CLIENT PORTAL: https://www.scottclarklawpc.com/client/login.aspx

COVID-19 ARIZONA UPDATES: https://www.clarkwalker.com/COVID-19.asp

COVID-19 NEVADA UPDATES: https://www.clarkwalker.com/COVID-19N.asp